Page 1 of 2

Loan

Posted: Wed Dec 10, 2014 2:10 pm

by jolmstead

I have a 401k Loan setup that doesn't seem to stop when the target is reached. Can anyone see what I have done wrong with this setup? Below are the steps used to create...

1. Setup a Pay Stub Account as an Accrual

2. Setup a Pay Stub Account as an Employee Deduction pointing to the Accrual Pay Stub Account with an Accrual Type of "Earning Adds, Deduction Subtracts"

3. Setup a Tax/Deduction as a Deduction with a Calculation Type of Fixed Amount (w/Target) pointing to the Pay Stub Account marked as an employee deduction

4. Under this Tax/Deduction I then entered each employee with an amount to be taken each pay period and a limit

5. On the first pay period I did a Pay Stub Amendment for the Pay Stub Account marked as an accrual with type Fixed for the amount of the loan

After this everything works exactly as expected, until the limit is hit. It just keeps on taking the amount specified in the Employee Settings. It even shows on the check stub that the YTD Amount is more than the Target Balance/Limit as well as showing the Accrual then going negative. How do I stop it from deducting once the limit is hit?

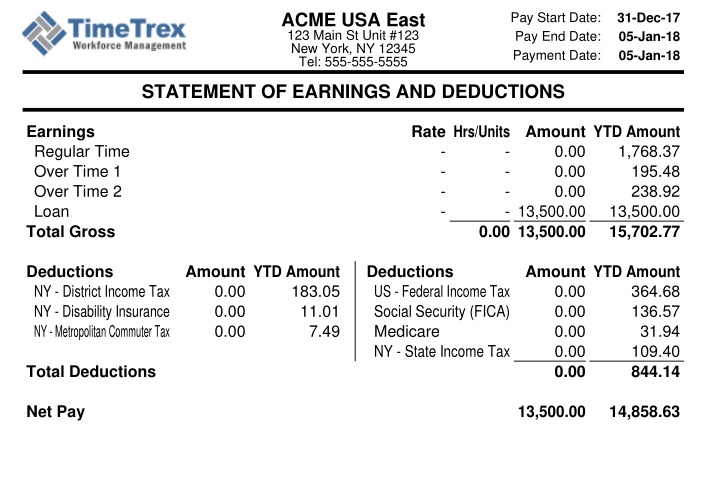

Attached is a capture of the check stub. The Limit set on the loan for this particular individual is $3,609.78 with an amount of $300.84 to be taken each pay period. In this case it went $0.30 over.

Thanks,

Jeremy

Re: Loan

Posted: Thu Dec 11, 2014 1:15 pm

by shaunw

What Target amount did you specify?

Re: Loan

Posted: Fri Dec 12, 2014 7:28 am

by jolmstead

The target amount specified was $3,609.78.

Re: Loan

Posted: Fri Dec 12, 2014 8:32 am

by shaunw

It appears that you have your Loan Accrual setup to go in reverse though, from $3,609.78 to $0.00, therefore the target should be the end result that you want, or $0.00.

Re: Loan

Posted: Mon Dec 15, 2014 12:02 pm

by jolmstead

Okay, that makes sense, but when I tried this, then it took nothing out.

Re: Loan

Posted: Wed Dec 17, 2014 10:33 am

by shaunw

Please post another copy of the Pay Stub and a screenshot of your Tax/Deduction settings.

Re: Loan

Posted: Wed Dec 17, 2014 1:24 pm

by jolmstead

Attached are...

Capture.PNG = Actual Pay Stub

tax_deduction1.PNG = The Tax/Deduction general setup

tax_deduction2.PNG = The Tax/Deduction employee settings with the item in question highlighted (though none of the work)

pay_stub_account1.PNG = The deduction portion of the pay stub account setup

pay_stub_account2.PNG = The accrual portion of the pay stub account setup

Re: Loan

Posted: Thu Dec 18, 2014 12:51 pm

by shaunw

In your Tax/Deduction record, set the "401K Loan-1 (Accrual)" as the Include Pay Stub Account, thats what TimeTrex uses to determine "target" amount.

Re: Loan

Posted: Mon Dec 22, 2014 7:36 am

by jolmstead

That seemed to do the trick...thank you.

Re: Loan

Posted: Fri Jan 09, 2015 9:50 am

by jolmstead

One more issue with this. The loan is now completely paid for and the employee was removed from the Employee Settings tab on the 401k Loan deduction, but it continues to show up on the check stub (example attached). Is there anyway to get it off the check stub?

Re: Loan

Posted: Fri Jan 09, 2015 10:10 am

by shaunw

My first guess would be that you have something causing a $0.00 amount to be calculated on the pay stub, such as another Tax/Deduction record, or a Pay Stub Amendment.

Re: Loan

Posted: Fri Jan 09, 2015 12:48 pm

by jolmstead

I don't think that is the case...I did a search for all amendments for the current period and there were none and I checked every Tax/Deduction and no other item points to the 401k Loan pay stub account. Are there any other possibilities?

Re: Loan

Posted: Mon Dec 18, 2017 4:25 pm

by gregory

This seems to be the recommended post for setting up loans. We are using 11.0.2 and want our loans to behave as indicated in the post where the accrual account shows the remaining balance to be paid and the tax/deduction has a target amount of $0.

We can get it to work the other way where the accrual account shows the amount repaid and the target is the amount of the loan. We cannot get the pay stub account screen to show the type field as shown above when accrual is chosen to select earning adds and deduction subtracts. Is there a different way with the current version.

Thanks,

Gregory

Re: Loan

Posted: Mon Dec 18, 2017 5:05 pm

by shaunw

gregory wrote: ↑Mon Dec 18, 2017 4:25 pm

This seems to be the recommended post for setting up loans. We are using 11.0.2 and want our loans to behave as indicated in the post where the accrual account shows the remaining balance to be paid and the tax/deduction has a target amount of $0.

We can get it to work the other way where the accrual account shows the amount repaid and the target is the amount of the loan. We cannot get the pay stub account screen to show the type field as shown above when accrual is chosen to select earning adds and deduction subtracts. Is there a different way with the current version.

This is a display problem in v11.0.2, it will be fixed in the next version of TimeTrex, due out this week sometime.

Re: Loan

Posted: Mon Dec 18, 2017 5:19 pm

by gregory

OK. Unrelated, but please note in company Information use second surname checkbox is never saved as checked.

Re: Loan

Posted: Mon Dec 18, 2017 6:28 pm

by shaunw

gregory wrote: ↑Mon Dec 18, 2017 5:19 pm

OK. Unrelated, but please note in company Information use second surname checkbox is never saved as checked.

I will pass that on to be investigated further.

Re: Loan

Posted: Tue Dec 26, 2017 6:30 am

by gregory

Second surname checkbox disappeared from company info screen.

Re: Loan

Posted: Thu Jan 04, 2018 12:07 pm

by gregory

Happy New Year 2018. Back to the original loan question. Ver 11.1.1 Set up accrual account called loanBalance. Set up Pay stub account Loan as earning and accrual account LoanBalance with type earning adds, deduction subtracts. Set up Tax/Deduction for Fixed Amount with Target ($0). The Tax/Deduction is working OK and see balance in accrual. Paying the employee the loan with an Out of Cycle paystub and the paystub does not show accrual balance nor add the positive amount to the accrual.

What am I missing?

Thanks

Re: Loan

Posted: Thu Jan 04, 2018 1:21 pm

by shaunw

If the loan earning on the pay stub isn't affecting the accrual, then you don't have the Earning - Loan Pay Stub Account setup correctly to link to the Loan pay stub accrual account.

Also, the accrual type should be Earning Subtracts, Deduction Adds, since when you pay the employee the loan on the pay stub, the balance should go into the negative (amount owing by employee), not into the positive (amount owing by employer).

FYI: The loan repayment is all setup automatically by default, which you can see the settings on our public self-serve demo too.

Re: Loan

Posted: Thu Jan 04, 2018 4:42 pm

by gregory

Re: Loan

Posted: Thu Jan 04, 2018 5:38 pm

by shaunw

Unfortunately I'm not able to replicate what you are seeing at all. Out-of-Cycle pay stubs with loan amounts show the balances for me.

You can use

https://demo.timetrex.com to login to the latest version if you like. Username: demoadmin1 Password: demo

Re: Loan

Posted: Fri Jan 05, 2018 11:33 am

by gregory

Went to site you indicated for current version demo and confirmed was 11.1.1. Deleted normal Jan 19 pay stub for Tristen Braun so that that employee would have NO pay stubs in that pay period.

Created out of cycle pay period with 13,500 loan earning ONLY. You can see pay stub in demo is out-of-cycle for Tristen dated 5 January or here:

- TTdemo Tristen Braun out of cycle loan payment.jpg (97.66 KiB) Viewed 13102 times

Notice NO accrual shown. I did not change any of the pay stub accounts only used what was already created.

Does this replication of issue on your demo system help?

Thanks

Re: Loan

Posted: Fri Jan 05, 2018 4:25 pm

by shaunw

Are you manually creating the entire pay stub under Payroll -> Pay Stubs, then clicking the "New" icon?

If so, currently that doesn't do any automated calculations for you whatsoever (ie: it won't calculate tax/deductions or accruals), so you wouldn't see any accrual account adjustments unless you did it manually as well. We normally don't recommend manually creating or editing pay stubs unless absolutely necessary, due to this and several other potential issues that can arise.

If you want the accruals to be handled automatically, you will need to use Pay Stub Amendments, then have TimeTrex generate the pay stubs for the employees itself.

Re: Loan

Posted: Sat Jan 06, 2018 7:30 am

by gregory

That did it. After many hours with TT it was not obvious that creating a new PayStub was different from generating a new PayStub. You guys do a good job with pop-up warnings, there should be an intermediate acknowledgement screen after clicking on New PayStub warning no calculations are done.

As every month we pay a fixed amount on the 15th which is then deducted on the normal PayStub at end of month I see 3 ways of creating the out of cycle pay stubs (see below). Are there others?

1 - Use pay stub amendments and generate out of cycle paystubs

2 - Manually create new Paystubs including earning, accrual and payment info

3 - Create tax/Deduction that only applies to out-of-cycle paystubs

If 1 and/or 2 can be created once and just copied from one month to another with new date that would be easy. I see how to do Copy and New 1 at a time, but not mass. 3 is easiest most months except for those when we have another out-of-cycle need that will not be paid simultaneously with the advance on the 15th, in which case we would have to disable tax/deduction, generate out-of-cycle paystub and then enable again.

Thanks for help.

Re: Loan

Posted: Sat Jan 06, 2018 10:23 am

by shaunw

As every month we pay a fixed amount on the 15th which is then deducted on the normal PayStub at end of month I see 3 ways of creating the out of cycle pay stubs (see below). Are there others?

1 - Use pay stub amendments and generate out of cycle paystubs

2 - Manually create new Paystubs including earning, accrual and payment info

3 - Create tax/Deduction that only applies to out-of-cycle paystubs

TimeTrex does not have any fully automated way to handle Pay Period Schedules with regular advances anymore, it used too about a decade ago but was used by so few people and added a large amount of complexity, it was eventually decided to be removed. It does of course handle advances in a manual way though.

Another option would be to create a Excel/CSV file that contains the advance amounts for each employee that you just import each month as Pay Stub Amendments. You could then create a Tax/Deduction that automatically deducts 100% of the advance amount on their regular pay stub so at least that part doesn't have to be manual.

If at all possible you may want to consider moving to a semi-monthly Pay Period Schedule to avoid advances and the many problems that come with them. Even though the idea for advances is to be "fixed" amounts, in practice there always seems to be some adjustments, since if an employee was away for a large portion of the first part of the month, the advances would always need to be adjusted so the employee doesn't get overpaid. As soon as you start making those adjustments, you are essentially now a semi-monthly pay period schedule doing a lot of manual work you wouldn't otherwise need to do.